West Bengal government announces major reforms in property stamp duty and land ownership policies, offering relief to citizens and simplifying property transactions.

Revolutionizing Property Stamp Duty

The West Bengal government has introduced a groundbreaking amendment to property stamp duty regulations, particularly concerning intra-family property transfers. Previously, a 0.5% stamp duty was levied on the registration of family gift deeds for land and property. However, in a significant move, the state budget has slashed this stamp duty to a nominal fee of maximum Rs 1,000, irrespective of the property’s value. This change is expected to bring substantial relief to a vast number of individuals involved in property transactions within families.

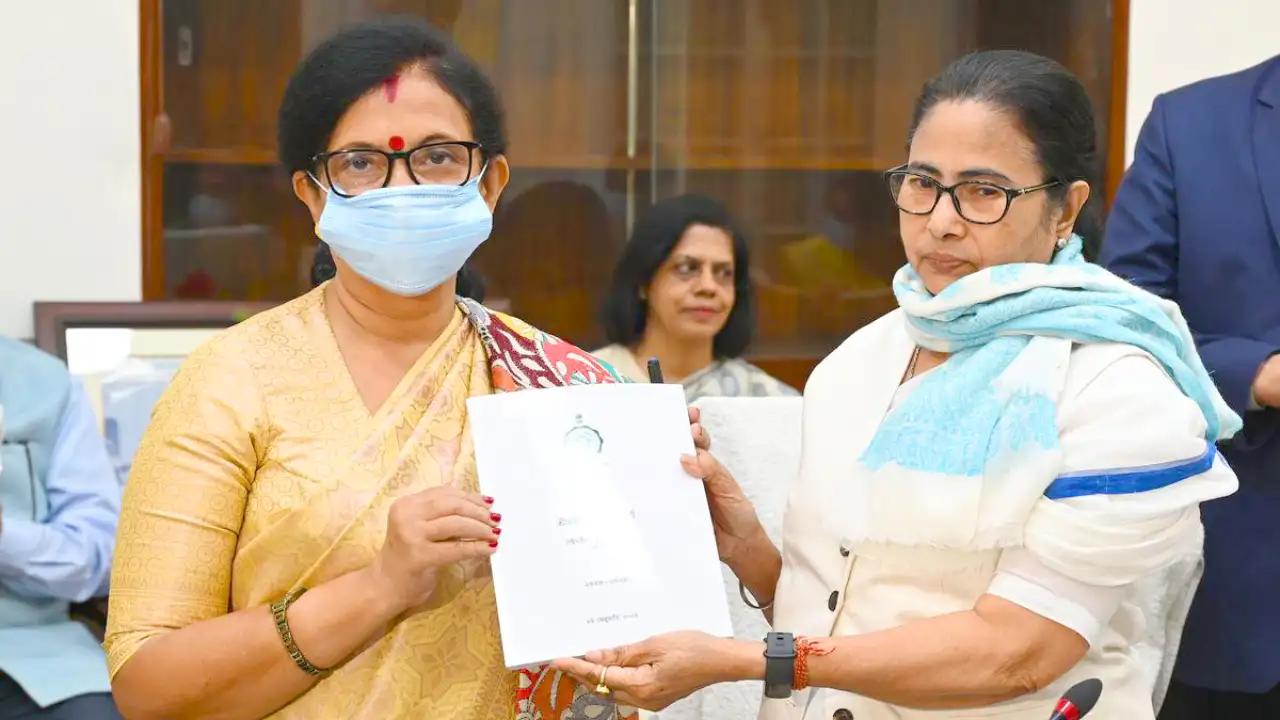

Ministerial Declaration

Minister of State for Finance, Chandrima Bhattacharya, expressed her satisfaction in proposing the maximum stamp duty reduction, emphasizing the government’s commitment to easing financial burdens on citizens.

Impact on Property Transactions

Previously, for a property valued at Rs 60 lakh, the stamp duty amounted to Rs 30,000. However, with the revised policy, registration can now be completed with a mere Rs 1,000 payment, resulting in significant savings of approximately Rs 29,000 for property owners.

Facilitating Land Ownership: Freehold Conversion

In addition to concessions on family property transfers, the state budget also announced a policy shift from leasehold to freehold land ownership. Finance Minister Chandrima Bhattacharya highlighted the government’s plan to implement freehold land ownership across various departments and agencies, offering recipients full ownership rights. This initiative aims to streamline land ownership processes and enhance transparency through the launch of a dedicated online portal.

Settlement of Dispute Scheme

Furthermore, Minister Bhattacharya proposed the introduction of a dispute settlement scheme to alleviate luxury tax arrears for hotel and restaurant owners. The scheme seeks to exempt penalties and interest on outstanding taxes, benefiting approximately 5,000 establishments across the state.

Temporary Relief Measures

It’s noteworthy that West Bengal has also temporarily reduced stamp duty rates by 2% and decreased circle rates by 10% until June 30, 2024, providing additional relief to property buyers and sellers during this period of transition.

Conclusion

The reforms introduced in the West Bengal Budget 2024 signify a paradigm shift in property transaction norms and land ownership policies. With a focus on easing financial burdens, promoting transparency, and fostering economic growth, these initiatives are poised to positively impact citizens and contribute to the state’s overall development trajectory.

Now You Can Follow Our Channel On WhatsApp!

Its great site. We would love to collabrate.

How to install your app. Please share the link.

Thank you for keeping me updated.

How can I contact the admin? Please let me know

Nice writeup.

Your website is very useful. Keep it up.

Very good info.

Very clear and point by point explained. I read your posts everyday. Keep it up.

Nice analysis.

This is a required step by government.

Very well explained and to the point information.

Very good budget presented by Mamata government.

Most comprehensive report. Well done authors.

You have presented the information in a very easy way. I am your regular reader.

Best website for finance news.

Bad move by government.

Very good content by indiastampduty.com

Mamata di is the best CM

Thankyou for sharing this.

Good measures taken by WB government.

Can I work with you and your website.

Impressive website.

Very good work.

I am from West Bengal. Mamata didi is doing good work.

Very good.

I want to express respect to the website owner for this great resource

Good helpful website.

Very nice information.

Thanks to share info about this.

Thank you.

Good Stuff!

Super Info!

Explained very well.

Your portal is known for its good content.

Well explained all the points!